What's Your Gender?

Male

Female

Enter your monthly income and see some interesting results

Edu-Fun Net 25%

Essential Net 55%

Safety Net 20%

Emergency Funds ( 3 ~ 6 Months Expenses )

Edu-Fun Net 25%

Essential Net 55%

Safety Net 20%

Emergency Funds ( 3 ~ 6 Months Expenses )

out of 100 SINGAPOREANS are earning more than you.

A Financial Tool That Intelligently Manage Your Life

Assist you in making smarter decisions in all 8 different verticals of Financial Planning.

Meet Mark, an experienced financial advisor and all his frustrations

Incredible · Instant · Insightful

3 Trackable Results

See incredible results by using our personal financial management tool.

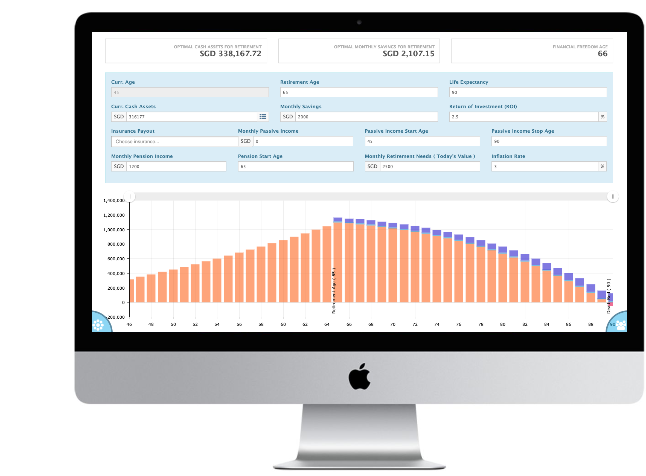

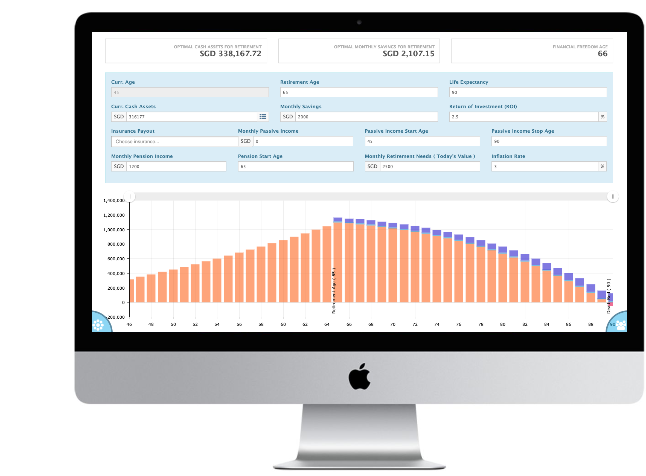

Proprietary retirement tool that will help you visualize how your retirement will look like down the road .— Sayeed

Most advanced and comprehensive insurance platform to manage your insurance and payments.— William Seah

Ease of identification and improvement on cashflow and insurance at a glance.— Denise Ang

What Users Are Saying About Us

Designed for people who likes simplicity yet able to handle the complexities of life.- Dianne

Have more questions? We are happy to talk to you.